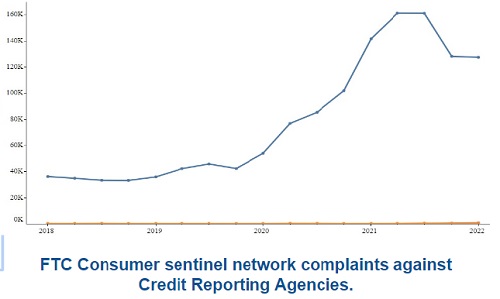

Consumers nationwide are being denied access to the credit they need, or paying thousands more in interest. Why? Because of inaccurate, incomplete, and conflicting credit reports. It does not matter the credit standing, excellent credit to poor credit. To compound the problem, the Credit Bureaus and Data Furnishers (Creditors) are giving little regard to consumer disputes. If the consumer is lucky to have their dispute answered, chances are it was in a generic form letter that does little to nothing to correct or delete the incorrect information damaging the consumer. In our 25+ years experience in the credit service industry, we have NEVER seen an accurate credit report! In fact, we contend there is no such thing as an accurate credit report.

Not to get too complicated, but there is a universal format that creditors use to report to the credit bureaus called Metro2. Take a look at your credit report. I am willing to bet if you set them side by side, looking at the same account, you will see that account reporting 3 different ways, yet as mentioned, they reported to the credit bureaus using the same system. So in reality that same account should show the same things across the board.

Credit scores are generated by the data in the credit report, so inaccurate or missing data will affect the credit score. Even a small error can cost a consumer a mortgage approval, or even affect the interest rate which can cost a consumer THOUSANDS of dollars.

Holding the bureaus accountable has been hard because properly auditing a bureau direct report has had to been done manually, which can take hours per account. Until now, the ability to automate the process did not exist. Because of this, Attorneys, by in large, have been unwilling to take smaller FCRA cases based on statutory damages alone. This is where CIAA (Consumer Information Accountability Advocates) comes in.

We now have the ability to extract the data from a credit bureau direct credit report from all 3 major credit bureaus, and parse (separate) the data. This is a HUGE step as this will enable us to apply the rules of the Metro2 and audit the reports amongst the bureaus that will help attorneys and credit service companies generate their basis of dispute in which will be automated as well. We call this Quantum Matrix Dispute Technology™. If the bureaus and/or furnishers do not properly modify the account to report with “maximum possible accuracy”, or delete the account(s) from the credit report, then the consumer could be entitled to compensation.

Being able to automate the bureau direct credit report audits will streamline the process and open a world of possibilities. Possibilities such as, more attorneys taking on more FCRA cases, even on simple cases involving statutory damages, creating more accountability to the credit industry, make credit repair relevant and effective again, and betters the financial lives of thousands or millions of consumers.

As you can see, the sky is the limit. The potential is there to make a hefty profit, but also help consumers for the greater good. There is a $10 million treasury cap for development and implementation, and projecting the average monthly to be around $3 million. We chose the DAO structure to help accelerate development of the business. We have a solid team comprised of developers and IT, credit service professionals, attorneys, and many others. We are actively recruiting top notch talent to ensure this project is as successful as it can possibly be. We welcome, in fact we encourage our investors to get their hands dirty, or at least share some connections that may be helpful to the cause. To learn more about this amazing investment opportunity, our structure, and your role in changing the future of our financial system, click the button below. Simply sign up for a membership and sign our NDA and Non-Compete and you will have full access to our business plan, and be able to contribute.

Maggie is a single mom, her ex stole her identity, ran up her credit and left her alone with two kids. Her credit rating is destroyed and the Credit Bureaus will not help her fix the errors. Maggie pays her bills and is having a hard time qualifying to get safe housing for her kids.

Our team is passionate to develop a top notch product for consumer attorneys, and CSO’s. We are more passionate about restoring our broken credit reporting system and restoring fairness and accuracy on consumer credit reports nationwide. We have a page dedicated specifically to introduce our team. Click the button below to learn more about our spectacular team!